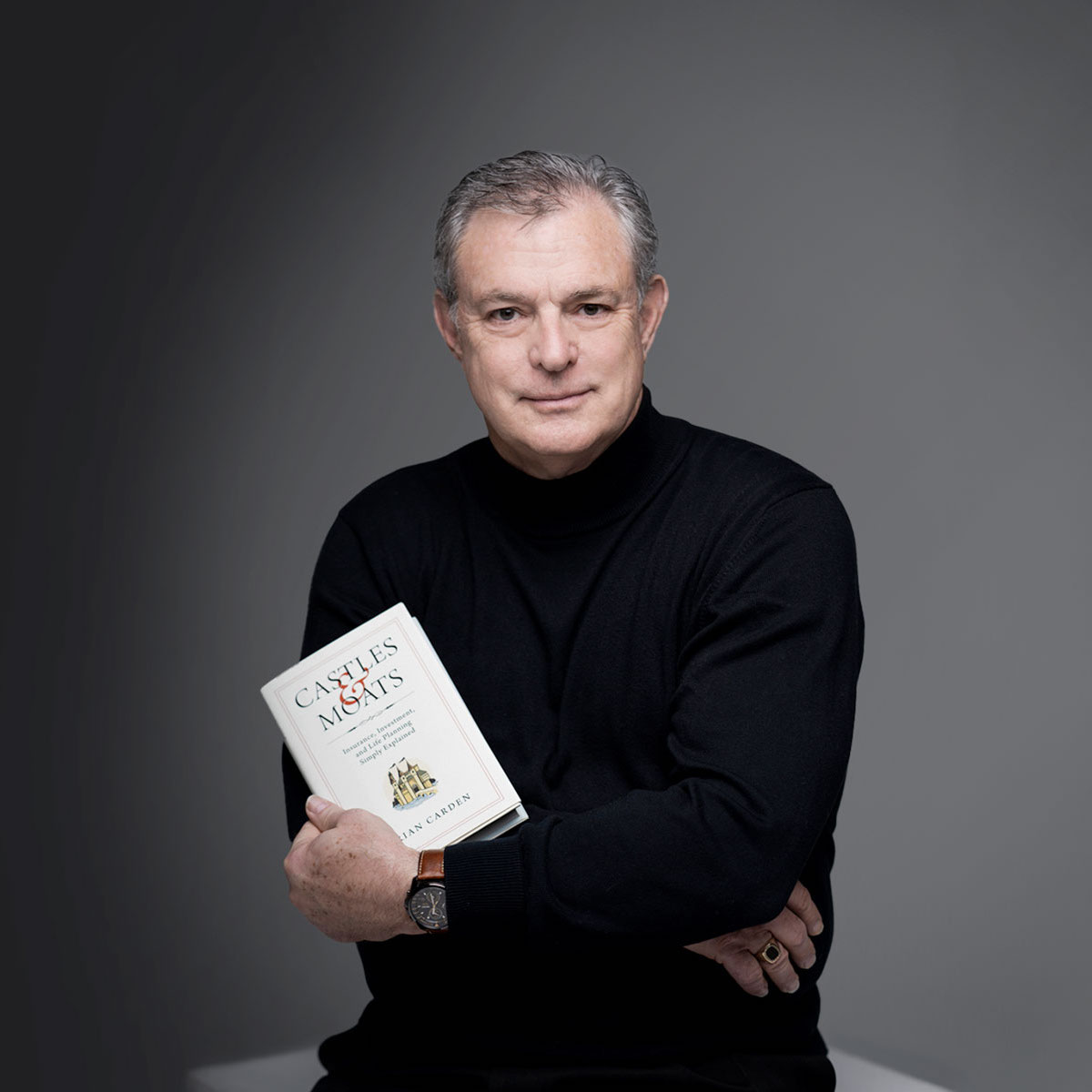

BRIAN CARDEN

Insurance & Financial Advisor

LIFE INSURANCE | LONG TERM CARE | MEDICARE

FINANCIAL MANAGEMENT

About Me

Advisor | Author | Professional Explainer

In 2023, independent advisor, author, and professional explainer Brian Carden celebrated 40 years in the insurance and financial services industries. For the benefit of his clients, he is licensed for life & health insurance, property & casualty insurance, and securities (Series 6, 63, 7, and 65), making him uniquely qualified to offer honest, open advice on virtually every insurance or financial need. As an independent advisor, Brian has access to a diverse selection of providers and products, and is prepared to make suitable recommendations for you, your family, and your business.

Brian considers himself a “protection first, comprehensive financial advisor,” which was the catalyst for him to author his book Castles & Moats: Insurance, Investment, and Life Planning Simply Explained. For the duration of his career, the hallmarks of his independent practice are his firm beliefs in asset allocation, behavioral finance, and investor behavior in an ever-changing landscape. Although Brian no longer sells property & casualty insurance, his mantra for his practice remains true: If you’re going to build a castle of wealth, you need a moat of protection!

Insurance Services

Life Insurance | Long Term Care Insurance | Medicare

Brian is passionate about helping his clients navigate the often complex Medicare onboarding process. He also endorses permanent life insurance when appropriate and understands how to effectively integrate some form of long-term care into your financial strategy.

Financial Services

Comprehensive | Sensible | Strategic

Brian believes that every available financial product should be considered, including savings accounts, Turnkey Asset Management Programs (TAMP), and both fixed and variable annuities. He will do everything possible to ensure that you do not outlive your retirement assets and create a legacy of love and significance for your heirs.

Recent Blogs

Insurance • Finance • Family

Get Connected